How Long Will The Money Released From An Overseas Bank

Smart Remittance

BNI Smart Remittance provides the best service for cross-edge payment using foreign exchange, both for Outgoing Transferand Incoming Transfer. Supported by competent man resources and the latest engineering, BNI Smart Remittance is committed to provide global payment services to fulfill the customer needs for cross-border payments.

BNI remittance services also supported by worldwide network through half dozen overseas branches (Singapore, Hong Kong, Tokyo, Seoul, London and New York), ane sub-branch (Osaka) and 1 representative office (Yangon), likewise every bit more than one,600 correspondent partners and Remittance Representative Officers that are located in Malaysia, Hong Kong, Taiwan, South korea, Saudi Arabia, Qatar, United Arab Emirates, and Netherlands. BNI too developed into the merely bank in Indonesia which obtain the laurels for "The All-time Remittance Provider in Southeast Asia" for xi sequent years (2009-2019) and has a call heart for remittance transactions which tin can exist reached throughphone number (021) 29946099.

1. Incoming Transfer (ITR)

Benefits :

- ITR to BNI Account, remittances from overseas creditted to BNI accounts.

- ITR Non-BNI Business relationship, remittances from overseas creditted to other domestic Banking company business relationship.

- BNI Wesel PIN, remittances from overseas which can exist collected in cash at BNI outlets, Mail Offices, Alfamart, Pegadaian, Agent 46 and other BNI Wesel Pin paying agents.

- BNI Mobile Remittance (BNI MoRe), BNI digital innovations to facilitate coin transfer from Singapore to Indonesia which can be accessed via mobile phones anywhere and anytime.

- Fast, easy, and secure remittance services.

- Global network through more than 1.600 correspondent partner and overseas branch.

- Competitive rates.

Requirements :

- A sender or applicant comes to an overseas remitting agent/BNI overseas branch by submitting remittance form, the funds and valid identity carte or through correspondent digital awarding.

- Bring a Pin number and identity bill of fare (Residential Identity Carte/Driver License) for a remittance beneficiary who collects the money at the BNI branch through the BNI Wesel PIN service.

- Meanwhile remittances received in a BNI savings account, they can be collected through BNI ATM, BNI outlets or Agen 46.

2. Outgoing Transfer (OTR)

Benefits :

- Multi-Currencies, remittance service that can exist received in 125 local currencies in various countries.

- Yuan Remittance, Won Remittance, and Ringgit Remittance products that make it easy to send money to Communist china, South korea and Malaysia.

- OTR Local Currency Settlement (LCS) product, a remittance service that tin can be sent and received in Malaysian Ringgit and Thailand Baht (MYR and THB) currencies.

- Mobile OTR characteristic that can be done through BNI Mobile Banking Personal.

- Competitive rate.

- Fast, money transfer can be received on the aforementioned day in accordance with applicative regulations.

Requirements :

- BNI client (not a walk-in client).

- Bring saving passbook to BNI branch (for Outgoing Transfer) and pay charges according to the provision.

- Adhere underlying documents that are in accord with OTR transaction needs.

Outgoing Transfer Rates

| NO. | DESCRIPTION | TERM AND CONDITION |

| 1 | Cover in IDR | Swift Charges IDR 35.000,-. |

| 2 | Cover in the aforementioned currency. |

|

| three | Embrace in other strange currencies. | Swift Charges IDR 35.000,-. |

| 4 | Full amount OTR (Guaranted OUR/Full Pay). - USD - Euro - SGD - AUD | + USD 25 + EUR 30 + SGD 30 + AUD 25 |

Outgoing Transfer Mobile Banking Personal

OTR Mobile Banking Personal is the digital revolutionary of international remittance transaction in Indonesia based on mobile application and smartphone. BNI OTR Mobile Banking Personal was launched on July 5th, 2019 and this apps offers many advantages to our customers including easy payment, unlimitied services, competitive charges, and friendly users.

Benefits :

- Easy payment, our customer is able to make remittance transaction only by smartphone and mobile apps which linked to our mobile banking service for 24 hours, without come to our branches or outlets.

- Friendly user, customer who already has Banking concern account and activate our mobile banking services is able to use this apps and make remittance transaction directly.

- Competitive charges, offers y'all less fee charges than other apps and remittance products.

Requirements :

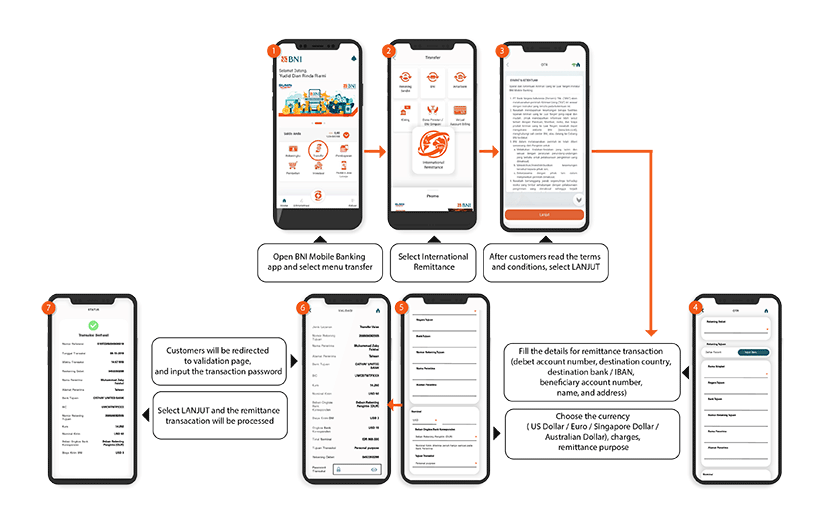

- Open up BNI Mobile Banking app.

- Select menu transfer and International Remittance.

- Later on customers read the terms and weather, printing LANJUT.

- Select debet business relationship number.

- Select new input.

- Cull destination country and Bank.

- Input the casher name and address.

- If customers prefer to apply the beneficiary account into favorite listing, checklist the pocket-sized box below and type the proper name.

- Choose the currency (U.s.a. Dollar/Euro/Singapore Dollar/Australian Dollar).

- Choose the charges (SHA/OUR).

- Select the remittance purpose.

- Customers volition be redirected to validation page.

- Input transaction password.

- Printing LANJUT and the remittance transaction volition exist processed.

Charges :

| No. | Currency | Provision Fees | Correspondent Bank Fees |

| 1. | USD | USD 3 | USD fifteen |

| ii. | EUR | EUR 2.5 | EUR 25 |

| iii. | AUD | AUD 4 | AUD 25 |

| 4. | SGD | SGD 4 | SGD 30 |

Source: https://www.bni.co.id/en-us/business/international/smartremittance

Posted by: valentinthaders.blogspot.com

0 Response to "How Long Will The Money Released From An Overseas Bank"

Post a Comment